Calculating car depreciation for tax purposes

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. See new and used pricing analysis and find out the best model years to buy for resale value.

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Calculate car depreciation by make or model.

. Depreciation formula The Car Depreciation Calculator. Suppose that you use a business vehicle 100 of. Ad Receive Pricing Updates Shopping Tips More.

A car that doesnt depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels. It is the traditional and widespread process of calculating your tax depreciation. By using the formula for the straight-line method the annual depreciation is calculated as.

Equal expensing each year so if you spent 30000 on your car on January 1st divided evenly over 5 years you would get a 6000 deduction per year. Note that this method. If a vehicles life is 8 years then on a straight line basis the depreciation each year will be ⅛ which is equivalent to 125.

Depreciation Limits For applicable vehicles the IRS caps depreciation deductions at. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. How to Calculate Salvage Value.

It is done by estimating the assets value by cost and what the business. This is called the Prime Cost method of depreciation. Before you use this tool.

The special car depreciation allowance equals 50 of your total depreciation write-off. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. The tool includes updates to.

This means the van depreciates at a rate of. Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. The standard mileage rate method or the actual expense method.

To compute business vehicle depreciation for the year you must multiply the basis amount by the percentage of business use of your vehicle. By accounting for each of the factors that contribute to car depreciation youll be able to figure out the exact value of your car for tax purposes and maximize your write-offs. Work-related car expenses calculator.

For a passenger auto placed in service in 2021 that cost more than 59000 the Year 1 depreciation ceiling is. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. It can be used for the 201314 to.

You can generally figure the amount of your deductible car expense by using one of two methods. Regardless of the method used the first step to calculating depreciation is subtracting an assets salvage value from its initial cost. If a vehicle is used 50 or less for business purposes you must use the straight-line method to calculate depreciation deductions instead of the percentages listed above.

These are indexed for inflation and may change annually. 35000 - 10000 5 5000.

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Car Depreciation For 1099 Contractors And Car Sharers

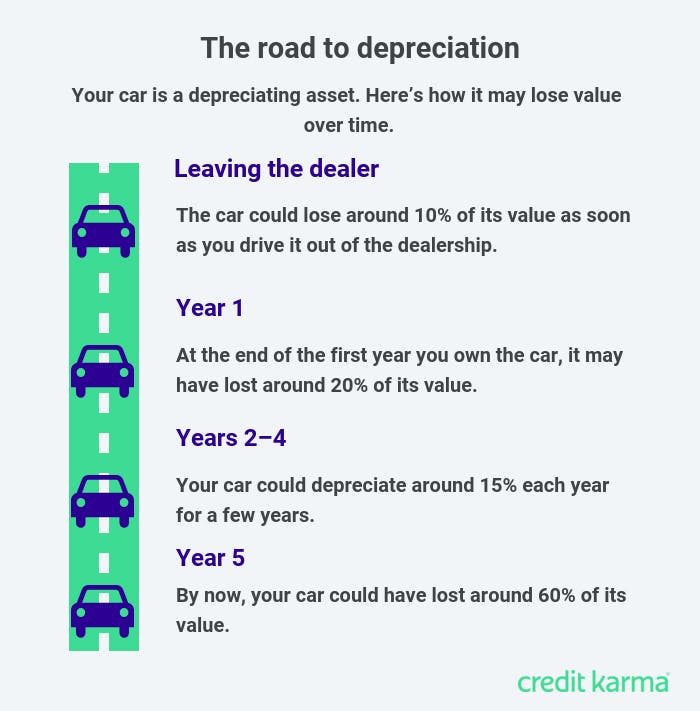

How Car Depreciation Affects Your Vehicle S Value Credit Karma

Car Depreciation Calculator

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Appreciation And Depreciation Calculator Https Salecalc Com Appdep Appreciation Calculator Calculators

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Tax Deductions Small Business Tax Deductions

![]()

6 000 Pound Vehicle List Special Irs Depreciation Tax Benefit Diminished Value Of Georgia

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Home Office Expense Spreadsheet Spreadsheets Offered Us The Probable To Input Transform And Tax Deductions Free Business Card Templates Music Business Cards

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

How Is Car Depreciation Calculated Credit Karma

Car Depreciation Rate And Idv Calculator Mintwise